Whitepaper

Preface

As the world becomes increasingly digital, cryptocurrency is a next natural step in the evolution of money. AiQueen is the first digital currency for everyday people, representing a major step forward in the adoption of cryptocurrency worldwide.

Our Mission: Build a cryptocurrency and smart contracts platform secured and operated by everyday people.

Our Vision: Build the world’s most inclusive online experience, fueled by AiQueen, the world’s most widely used cryptocurrency.

AiQueen Economic Model: Balancing Scarcity and Access

One of Bitcoin’s most impressive innovations is its marriage of distributed systems with economic game theory.

Pros

Fixed Supply

Bitcoin’s economic model is simple. There will only ever be 21 million Bitcoin in existence. This number is set in code. With only 21M to circulate among 7.5B people around the world, there is not enough Bitcoin to go around. This scarcity is one of most important drivers of Bitcoin’s value.

Decreasing Block Reward

Bitcoin’ distribution scheme, further enforces this sense of scarcity. The Bitcoin block mining reward halves every 210,000 blocks (approximately every ~4 years.) In its early days, the Bitcoin block reward was 50 coins. Now, the reward is 12.5, and will further decrease to 6.25 coins in May 2020. Bitcoin’s decreasing rate of distribution means that, even as awareness of the currency grows, there is less to actually mine.

Cons

Inverted Means Uneven

Bitcoin’s inverted distribution model (less people mining more in the beginning, and more people mine less today) is one of the primary contributors to its uneven distribution. With so much Bitcoin in the hands of a few early adopters, new miners are “burning” more energy for less bitcoin.

Hoarding Inhibits Use As A Medium Of Exchange

Although Bitcoin was released as a “peer to peer electronic cash” system, the relative scarcity of Bitcoin has impeded Bitcoin’s goal of serving as a medium exchange. Bitcoin’s scarcity has led to its perception as a form of “digital gold” or a digital store of value. The result of this perception is that many Bitcoin holders are unwilling to spend Bitcoin on day-to-day expenses.

The AiQueen Economic Model

AiQueen, on the other hand, seeks to strike a balance between creating a sense of scarcity for AiQueen, while still ensuring that a large amount does not accumulate into a very small number of hands. We want to make sure our users mine more AiQueen as they make contributions to the network. AiQueen’s goal is to build an economic model that is sophisticated enough to achieve and balance these priorities while remaining intuitive enough for people to use.

AiQueen’s economic model design requirements:

§ Simple: Build an intuitive and transparent model

§ Fair distribution: Give a critical mass of the world’s population access to AiQueen

§ Scarcity: Create a sense of scarcity to sustain AiQueen’s price over time

§ Meritocratic mining: Reward contributions to build and sustain the network

AiQueen – Token Supply

Token Emission Policy

1. Total Max Supply = M + R + D

M = total mining rewards

R = total referral rewards

D = total developer rewards

2. M = ∫ f(P) dx where f is a logarithmically declining function

P = Population number (e.g., 1st person to join, 2nd person to join, etc.)

3. R = r * M

r = referral rate (50% total or 25% for both referrer and referee)

4. D = t * (M + R)

5. t = developer reward rate (25%)

M – Mining Supply (Based on fixed mining supply minted per person)

In contrast to Bitcoin which created a fixed supply of coins for the entire global population, AiQueen creates a fixed supply of AiQueen for each person that joins the network up to the first 100 Million participants. In other words, for each person that joins the AiQueen Network, a fixed amount of AiQueen is pre-minted. This supply is then released over the lifetime of that member based on their level of engagement and contribution to network security. The supply is released using an exponentially decreasing function similar to Bitcoin’s over the member’s lifetime.

R – Referral Supply (Based on fixed referral reward minted per person and shared b/w referrer and referee)

In order for a currency to have value, it must be widely distributed. To incentivize this goal, the protocol also generates a fixed amount of AiQueen that serves as a referral bonus for both the referrer and the referee (or both parent and offspring. This shared pool can be mined by both parties over their lifetime – when both parties are actively mining. Both referrer and referee are able to draw upon this pool in order to avoid exploitative models where referrers are able to “prey” on their referees. The referral bonus serves as a network-level incentive to grow the AiQueen Network while also incentivizing engagement among members in actively securing the network.

D – Developer Reward Supply (Additional AiQueen minted to support ongoing development)

AiQueen will fund its ongoing development with a “Developer Reward” that is minted alongside each AiQueen coin that is minted for mining and referrals. Traditionally, cryptocurrency protocols have minted a fixed amount of supply that is immediately placed into treasury. Because AiQueen’s total supply is dependent on the number of members in the network, AiQueen progressively mints its developer reward as the network scales. The progressive minting of AiQueen’s developer reward is meant to align the incentives of AiQueen’s contributors with the overall health of the network.

f is a logarithmically decreasing function – early members mine more

While AiQueen seeks to avoid extreme concentrations of wealth, the network also seeks to reward earlier members and their contributions with a relatively larger share of AiQueen. When networks such as AiQueen are in their early days, they tend to provide a lower utility to participants. For example, imagine having the very first telephone in the world. It would be a great technological innovation but not extremely useful. However, as more people acquire telephones, each telephone holder gets more utility out of the network. In order to reward people that come to the network early, AiQueen’s individual mining reward and referral rewards decrease as a function of the number of people in the network. In other words, there is a certain amount of AiQueen that is reserved for each “slot” in the AiQueen Network.

Utility: Pooling and monetizing our time online

Today, everyone is sitting on a veritable treasure trove of untapped resources. Each of us spend hours day on our phones. While on our phones, each of our views, posts or clicks creates extraordinary profits for large corporations. At AiQueen, we believe that people have the right to capture value created from their resources.

We all know that we can do more together than we can alone. On today’s web, massive corporations like Google, Amazon, Facebook have immense leverage against individual consumers. As a result, they are able to capture the lionshare of value created by individual consumers on the web. AiQueen levels the playing field by allowing its members to pool their collective resources so they can get a share of the value that they create.

The graphic below is the AiQueen Stack, where we see particularly promising opportunities for helping our members capture value. Below, we go into each of these areas in more detail.

Introducing the AiQueen Stack – Unleashing underutilized resources

AiQueen Ledger And Shared Trust Graph – Scaling Trust Across The Web

One of the biggest challenges on the internet is knowing who to trust. Today, we rely on the rating systems of providers such as Amazon, eBay, Yelp, to know who we can transact with on the internet. Despite the fact that we, customers, do the hard work of rating and reviewing our peers, these internet intermediaries capture the lionshare of the value created by this work.

AiQueen’s consensus algorithm, described above, creates a native trust layer that scales trust on the web without intermediaries. While the value of just one individual’s Security Circle is small, the aggregate of our individual security circles builds a global “trust graph” that helps people understand who on the AiQueen Network can be trusted. The AiQueen Network’s global trust graph will facilitate transactions between strangers that would not have otherwise been possible. AiQueen’s native currency, in turn, allows everyone who contributes to the security of the network to capture a share of the value they have helped create.

AiQueen’s Attention Marketplace – Bartering Unutilized Attention And Time

AiQueen allows its members to pool their collective attention to create an attention market much more valuable than any individual’s attention alone. The first application built on this layer will be a scarce social media channel currently hosted on the home screen of the application. You can think of the scarce social media channel as Instagram with one global post at a time. AiQueenoneers can wager AiQueen to engage the attention of other members of the network, by sharing content (e.g., text, images, videos) or asking questions that seek to tap into the collective wisdom of the community. On the AiQueen Network, everyone has the opportunity to be an influencer or to tap into the wisdom of the crowd. To date, AiQueen’s Core Team has been using this channel to poll the community’s opinion on design choices for AiQueen (e.g. the community voted on the design and colors of the AiQueen logo.) We have received many valuable responses and feedback from the community on the project. One possible future direction is to open the attention market for any AiQueenoneer to use AiQueen to post their content, while expanding the number of channels hosted on the AiQueen Network.

In addition to bartering attention with their peers, AiQueenoneers may also opt into bartering with companies that are seeking their attention. The average American sees between 4,000 and 10,000 ads a day. Companies fight for our attention and pay tremendous amounts of money for it. But we, the customers, receive no value from these transactions. In AiQueen’s attention marketplace, companies seeking to reach AiQueenoneers will have to compensate their audience in AiQueen. AiQueen’s advertising marketplace will be strictly opt-in only and will provide an opportunity for AiQueenoneers to monetize one of their greatest untapped resources: their attention.

AiQueen’s Barter Marketplace – Build Your Personal Virtual Storefront

In addition to contributing trust and attention to the AiQueen Network, we expect AiQueenoneers to be able to contribute their unique skills and services in the future. AiQueen’s mobile application will also serve as a Point of Sales where AiQueen’s members can offer their untapped goods and services via a “virtual storefront” to other members of the AiQueen Network. For example, a member offers up an underutilized room in their apartment for rent to other members on the AiQueen Network. In addition to real assets, members of the AiQueen Network will also be able to offer skills and services via their virtual storefronts. For example, a member of the AiQueen Network could offer their programming or design skills on the AiQueen marketplace. Overtime, the value of AiQueen will be supported by a growing basket of goods and services.

AiQueen’s Decentralized App Store – Lowering The Barrier Of Entry For Creators

The AiQueen Network’s shared currency, trust graph, and marketplace will be the soil for a broader ecosystem of decentralized applications. Today, anyone that wants to start an application needs to bootstrap its technical infrastructure and community from scratch. AiQueen’s decentralized applications store will allow Dapp developers to leverage AiQueen’s existing infrastructure as well as the shared resources of the community and users. Entrepreneurs and developers can propose new Dapps to the community with requests for access to the network’s shared resources. AiQueen will also build its Dapps with some degree of interoperability so that Dapps are able to reference data, assets, and processes in other decentralized applications.

Governance - Cryptocurrency for and by the people

Challenges w/ 1st Generation Governance models

Trust is the foundation of any successful monetary system. One of the most important factors engendering trust is governance or the process by which changes are implemented to the protocol over time. Despite its importance, governance is often one of the most overlooked aspects of crypto-economic systems.

First generation networks such as Bitcoin largely avoided formal (or “on-chain”) governance mechanisms in favor of informal (or “off-chain”) mechanisms arising from a combination of role and incentive design. By most measures, Bitcoin’s governance mechanisms have been quite successful, allowing the protocol to grow dramatically in scale and value since its inception. However, there have also been some challenges. The economic concentration of Bitcoin has led to a concentration of political power. The result is that everyday people can get caught in the middle of destructive battles between massive holders of Bitcoin. One of the most recent examples of this challenge has been the ongoing battle between Bitcoin and Bitcoin Cash. These civil wars can end in a fork where or where the blockchain. For token holders, hard forks are inflationary and can threaten the value of their holdings.

AiQueen’s Governance Model – a two-phase plan

In an article challenging the merits of on-chain governance, Vlad Zamfir, one of Ethereum’s core developers, argues that blockchain governance “is not an abstract design problem. It’s an applied social problem.” One of Vlad’s key points is that it is very difficult to design governance systems “a priori” or before observations of the particular challenges arising from a specific political system. One historical example is in the founding of the United States. The first experiment with democracy in the United States, the Articles of Confederation, failed after an eight-year experiment. The Founding Fathers of the United States were then able to draw upon the lessons of the Article of Confederation to craft the Constitution – a much more successful experiment.

To build an enduring governance model, AiQueen will pursue a two-phase plan.

Provisional Governance Model (< 5M Members)

Until the network hits a critical mass of 5M members, AiQueen will operate under a provisional governance model. This model will most closely resemble “off-chain” governance models currently employed by protocols like Bitcoin and Ethereum, with AiQueen’s Core Team playing an important role in guiding the development of the protocol. However, AiQueen’s Core Team will still rely heavily on the input of the community. The AiQueen mobile application itself is where AiQueen’s core team has been soliciting community input and engaging with AiQueenoneers. AiQueen embraces community critiques and suggestions, which is implemented by the open-for-comments features of AiQueen’s landing page, FAQs and Whitepaper. Whenever people browse these materials on AiQueen’s websites, they can submit comments on a specific section right there to ask for questions and make suggestions. Offline AiQueenoneer meetups that AiQueen’s core team have been organizing will also be an important channel for community input.

Additionally, AiQueen’s Core Team will develop more formal governance mechanics. One potential governance system is liquid democracy. In liquid democracy, every AiQueenoneer will have the ability to either vote on an issue directly or to delegate their vote to another member of the network. Liquid democracy would allow for both broad and efficient membership from AiQueen’s community.

AiQueen’s “Constitutional Convention” (> 5M Members)

Upon hitting 5M members, a provisional committee will be formed based on previous contributions to the AiQueen Network. This committee will be responsible for soliciting and proposing suggestions from and to the wider community. It will also organize a series of on- and offline conversations where AiQueen’s members will be able to weigh on AiQueen’s long-term constitution. Given AiQueen’s global user base, the AiQueen Network will conduct these conventions at multiple locations across the world to ensure accessibility. In addition to hosting in-person conventions, AiQueen will also use its mobile application as a platform for allowing AiQueen’s member to participate in the process remotely. Whether in-person or online, AiQueen’s community members will have the ability to participate in the crafting AiQueen’s long-term governance structure.

Token Model and Mining

A well thought-out, sound token design is critical to the success of a cryptocurrency network. It has the potential to create incentives to bootstrap network formation and growth, build a utilities-driven ecosystem, and thereby support the cryptocurrency underpinning such a system. What a network incentivizes says a lot about what a network needs—for example, network growth or fundamentals-driven utility creation, a mere store of value or a medium of exchange for the crypto native ecosystem. This chapter covers the supply of AiQueen and how AiQueenoneers can mine AiQueen in different phases of the network, and the underlying design rationale for different mining mechanisms including to build and grow the network and to incentivize the creation of a utilities-based ecosystem. Note that AiQueen is a layer one cryptocurrency running on its own blockchain, which “token” here refers to.

AiQueen Supply

AiQueen Network’s vision is to build the world’s most inclusive peer-to-peer ecosystem and online experience, fueled by AiQueen, the world’s most widely used cryptocurrency. To deliver on this vision, it is important to grow the network and make AiQueen widely accessible while maintaining the security of the blockchain and long-term network incentives. While these goals have always guided the token supply model and mining design, the key distinction is: the pre-Mainnet phases focused on driving network growth and widely distributing AiQueen and the Mainnet phase will focus on rewarding more diverse forms of AiQueenoneer contributions necessary for ecosystem building and utilities creation.

Pre-Mainnet Supply

In the early stages, the focus of AiQueen Network was on growing and securing the network. BootstrapPing to build a critical mass of participants is paramount to any network and ecosystem. Driven by the vision to make AiQueen the world’s most widely used cryptocurrency, distributing AiQueen and making it accessible globally further added to the focus on growth. AiQueen’s consensus algorithm relies on a global trust graph, which is aggregated from the Security Circles of individual AiQueenoneers. It was, therefore, critical to incentivize AiQueenoneers to form individual Security Circles. This meant a supply of tokens available as mining rewards that was not explicitly capped before Mainnet.

At the same time, maintaining long-term network incentives is important. As explained under the Mining section, the network adopted a mining mechanism where the network mining rate halves every time the network size increases by 10 times, resulting in a series of halving events when it reaches various milestones of engaged AiQueenoneers. The next halving event based on this model would be when the network reaches 100 million engaged AiQueenoneers. Currently, we have over 45 million Engaged AiQueenoneers. The network also retained an option to stop all mining altogether in the event that the network reached a certain size, which was, however, yet to be determined. The option to cap the supply of AiQueen was not exercised before Mainnet, therefore leaving the total supply undefined.

The pre-Mainnet supply model with a mining mechanism tailored to accessibility, growth and security has bootstrapped a community of over 30 million engaged AiQueenoneers with millions of intertwined Security Circles. A simple, accessible means to mine AiQueen on a mobile phone helped distribute the tokens widely throughout the world, including among populations that have been left out of the crypto revolution because of a lack of capital, knowledge or technology. In doing so, the network avoided the extreme token concentration evident in Bitcoin and other cryptocurrencies, preparing itself to become a true peer-to-peer decentralized ecosystem with a large enough volume of participants and transactions for utility creation.

Mainnet Supply

Supply fuels growth and incentivizes necessary contributions to the network to achieve an organically viable ecosystem. To that end, mining rewards will continue after Mainnet but will take diverse forms to incentivize different types of contributions, which will be explained in the Mining section below. In regard to supply, the undetermined supply due to the pre-Mainnet mining mechanism that optimizes for accessibility and growth of the network presents a few problems for the Mainnet phase, including unpredictability in planning, over-rewarding and under-rewarding of different types of necessary contributions in the new phase, and challenges to maintaining long-term network incentives. To address these issues, the network will shift from its pre-Mainnet supply model that is completely dependent on network behavior to the Mainnet supply model where there is a clear maximum supply.

The issue of unpredictability for planning in the pre-Mainnet supply model surfaced in AiQueen Network’s first COiNVENTION in September-October 2020 where the community panel and community submissions discussed whether mining should be halved or stopped at the network size of 10 million at the time. The diverse voices of community members presented the following dilemma for the network. If mining continued based on the ongoing (pre-Mainnet) mining mechanism, then it raised concerns with respect to AiQueen’s ability to provide long-term network incentives. However, if mining stopped, it would hurt the growth of the network and prevent new AiQueenoneers joining the network as miners, thereby undermining the accessibility of AiQueen. Even though the network moved on from that decision and halved the mining rate at its 10 Million size, this dilemma still remains and needs to be resolved.

How the community can achieve continued growth and accessibility while addressing concerns about supply is one of the main factors considered in the design of the Mainnet token model. In addition, the undefined and unpredictable total supply makes it hard to have overall network token planning because the community as a collective and the ecosystem itself have needs to use some AiQueen for purposes that benefit the community and ecosystem as a whole, other than only mining rewards for individuals, as evidenced by almost every other blockchain network. Clear allocations for such collective community purposes need to be defined. Hence, given the current network size of over 30 million AiQueenoneers and the expected volume of transactions and activities in the future, the Mainnet supply model has a clear maximum total supply of 100 billion AiQueen allowing incentivizations of continued growth and new contributions while removing the concerns about the unpredictability of the supply.

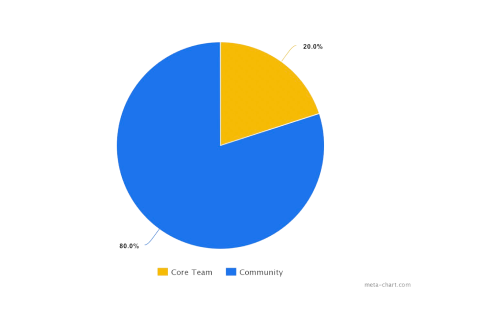

The supply distribution will honor the original distribution principle in the March 14, 2019 Whitepaper—the AiQueen community has 80% and the AiQueen Core Team has 20% of the total circulating supply of AiQueen, regardless of how much circulating supply there is in the AiQueen Network at any given point in time. Thus, given a total max supply of 100 billion AiQueen, the community will eventually receive 80 billion AiQueen and the Core Team will eventually receive 20 billion AiQueen. The following AiQueen chart depicts the overall distribution. The Core Team’s allocation gets unlocked at the same pace as the community progressively mines more and more AiQueen and may be subject to additional lockup through a self-imposed mandate. This means that if the community has a portion of its allocation in circulation (for example, 25%), only the proportional amount in Core Team’s allocation (in this example, 25%) can get unlocked at most.

This distribution above shows that AiQueen Network does not have any allocation for ICO and is NOT running any type of crowdfunding sales of AiQueen. Thus, any impersonation of AiQueen Network or its founders to conduct a sale or listing is illegal, unauthorized and fake. These impersonators have no affiliation with AiQueen Core Team. AiQueenoneers should beware of any scams and not participate. AiQueen can be mined freely by contributing to the ecosystem. Further, all mined AiQueen can only be claimed from inside the AiQueen App through the Mainnet dashboard and then transferred into your AiQueen wallet. Any website asking AiQueenoneers to claim AiQueen in other means is fake.

The 80% of the community supply is further divided into: 65% allocated for all past and future AiQueenoneer mining rewards, at address GBQQRIQKS7XLMWTTRM2EPMTRLPUGQJDLEKCGNDIFGTBZG4GL5CHHJI25 on the Mainnet, 10% reserved for supporting community organization and ecosystem building that will eventually be managed by a AiQueen Foundation, a non-profit organization in the future, at address GDPDSLFVGEPXFJKGZXSTJCPTSKKAI4KBHBAQCCKQDXISW3S5SJ6MGMS, and 5% reserved for the liquidity pool to provide liquidity for AiQueenoneers and developers in the AiQueen ecosystem at address GB7HLN74IIY6PENSHHBBJJXWV6IZQDELTBZNXXORDGTL75O4KC5CUXEV. The following table depicts the community supply distribution:

| Community Allocations | AiQueen Community Distribution (Out of Projected 800 Billion AiQueen Total) |

| Pre-mainnet Mining Rewards | 200 billion AiQueen Tokens (approx.) |

| Mainnet Mining Rewards | 450 billion AiQueen Tokens (approx.) |

| Liquidity Pool reserve | 50 billion AiQueen Tokens |

| Foundation reserve (Grants, Community events, etc.) | 100 billion AiQueen Tokens |

65 Billion AiQueens will be allocated for all mining rewards—both past and future mining. For past mining rewards, the rough sum of all AiQueen mined by all AiQueenoneers so far (before Mainnet) is about 30 Billion AiQueen. However, after prohibiting the migration of the AiQueen in fake accounts, the pre-Mainnet mined AiQueen at the beginning of the Open Network can be estimated to range from 10 to 20 Billion. The remaining amount in the 65 billion AiQueen supply for mining rewards will be distributed to AiQueenoneers through the new Mainnet mining mechanism with conceptual yearly supply limits.

Such yearly supply limits will be determined based on a declining formula. The yearly limit may be computed on a more granular basis such as by the day or by an even smaller time epoch dynamically, depending on factors such as the lockup ratio and the remaining supply of the network at the time. Such calculation of supply limits based on granular time epochs helps achieve a better and more smooth allocation curve through time. For the sake of simplicity here, let’s suppose that the time epoch is yearly. The declining formula would mean that the yearly supply limit for the first year of new Mainnet mining will be higher than for the second year, the second year’s higher than the third year’s, and so on. The yearly declining formula and these numbers will need to be finalized closer to the launch of the Open Network period of Mainnet once we will have seen how much of their mined AiQueen they have transferred into Mainnet.

At Mainnet, AiQueenoneers will be rewarded for their continued contributions to the growth and security of the network. As explained in the Mining section, AiQueenoneer rewards will be further diversified because the network needs more diverse and in-depth contributions related to app usage, node operation, and AiQueen lockup. Pre-Mainnet AiQueenoneers will continue to contribute to AiQueen and mine from the Mainnet mining rewards, along with any new members joining the network, to ensure growth and longevity of the network.

10 Billion AiQueen will be reserved for community organization and ecosystem building that will be, in the future, managed by a non-profit foundation. Most decentralized networks or cryptocurrencies, even though they are decentralized, still need an organization to organize the community and set the future direction of the ecosystem, e.g., Ethereum and Stellar. The future AiQueen foundation will (1) organize and sponsor community events, such as developer conventions, global online events and local community meetings, (2) organize volunteers and committee members, and pay full-time employees who are dedicated to building the community and ecosystem, (3) gather opinions and feedback from the community, (4) organize future community votings, (5) build branding and protect the reputation of the network, (6) represent the network to interact with other business entities including governments, traditional banks, and traditional enterprises, or (7) fulfill any number of responsibilities for the betterness of the AiQueen community and ecosystem. Further, in order to build a utilities-based AiQueen ecosystem, various community developer programs will be designed, created and carried out by the foundation to support community developers in the forms of grants, incubations, partnerships, etc.

5 billion AiQueen will be reserved for liquidity pools to provide liquidity for any ecosystem participants, including AiQueenoneers and AiQueen apps developers. Liquidity is key for an ecosystem to be viable, active, and healthy. If businesses or individuals want to participate in ecosystem activities (e.g., by selling and buying goods and services in AiQueen), they must have timely access to AiQueen. Without liquidity, the ecosystem will not have a healthy flow of AiQueen, hence harming the creation of utilities.

As discussed in the Roadmap chapter, one benefit of the Enclosed Network period of the Mainnet is to allow calibrations on the token model, if any, based on the early Mainnet results. Therefore, the token model is subject to tweaking before the Open Network period starts. Also, in the future, for the health of the network and ecosystem, the network may face questions such as whether there needs to be any inflation after the completion of the distribution of the 100 Billion AiQueen. The inflation may be necessary to further incentivize contributions through more mining rewards, make up for any loss of AiQueen from circulation due to accidents or death, provide for more liquidity, mitigate hoarding that inhibits usage and utility creation, etc. At that time, the foundation and its committees specialized in these matters will organize and guide the community to reach a conclusion on the matter in a decentralized way.

Mining Mechanism

AiQueen Network’s mining mechanism has been allowing AiQueenoneers to contribute to the growth, distribution and security of the network and be rewarded in AiQueen meritocratically. The pre-Mainnet mining mechanism has helped the network achieve an impressive growth of over 35 million engaged members, a widely distributed currency and Testnet, and a trust graph of Security Circle aggregates that will feed the consensus algorithm of the AiQueen blockchain.

Looking ahead into the Mainnet phase, AiQueen Network needs further contributions, as well as more diverse types of contributions from all its members, to become a true ecosystem while continuing its growth and inclusion. In the Mainnet phase, we want to further achieve decentralization, utilities, stability and longevity, in addition to growth, inclusion, and security. These goals can only be achieved if all AiQueenoneers in the network work together. Hence, the new AiQueen mining mechanism is designed to achieve these goals by incentivizing all AiQueenoneers to contribute diversely to the network based on the same meritocratic principle. Below, we first describe the pre-Mainnet mining formula, followed by the changes in the Mainnet formula. The Mainnet mining formula went into effect in March, 2022 – during the Enclosed Mainnet period of the Roadmap that started on December 28, 2021.

Pre-Mainnet Formula

The pre-Mainnet mining formula demonstrates a meritocratic determination of a AiQueenoneer’s hourly mining rate. Actively mining AiQueenoneers received at least a minimum rate and were further rewarded for their contributions to security and growth of the network. The following formula determined the rate at which AiQueenoneers mined AiQueen per hour:

M = I(B,S) + E(I), where

§ M is the total AiQueenoneer mining rate,

§ I is the Individual AiQueenoneer base mining rate,

§ B is the systemwide base mining rate,

§ S is the Security Circle reward, which is a component of the individual AiQueenoneer base mining rate from valid Security Circle connections, and

§ E is the Referral Team reward from active Referral Team members.

The systemwide base mining rate B started as 31.415926 AiQueen/h and halved every time the network of Engaged AiQueenoneers increased in size by a factor of 10x, starting at 1000 AiQueenoneers. As listed below, there have been five halving events thus far:

| Community Allocations | <1,000 | 1,000 | 10,000 | 100,000 | 1,000,000 | 10,000,000 |

| Pre-mainnet Mining Rewards | 31.4 | 15.7 | 7.8 | 3.9 | 1.9 | 1.0 |

| Mainnet Mining Rewards | 62.8 | 31.4 | 15.7 | 7.8 | 3.9 | 1.9 |

Here,

§ I(B,S) = B + S(B)

§ S(B) = 0.2 • min(Sc,5) • B, where

§ Sc is the count of valid Security Circle connections.

§ E(I) = Ec • I(B,S) • 0.25, where

§ Ec is the count of active Referral Team members who mine concurrently.

The mining formula can also be written as a multiple of B:

§ M = I(B,S) + E(I)

§ M = + , or

§ M = + , or

§ M = B • , or

§ M = B •

Pre-Mainnet Systemwide Base Mining Rate

Every active AiQueenoneer received at least the systemwide base mining rate (B). That is, if Sc = 0 and Ec = 0 in the mining formula above, then M = B. In any case, the total AiQueenoneer mining rate was a multiple of the systemwide base mining rate. The value of B was pre-determined before the Mainnet, and as shown in the table above, it changed only five times. The max supply was undetermined due to the dynamic progress of the pre-Mainnet mining mechanism, e.g. how large the network is and how fast the network reaches the next halving event. It would only be determined when B dropped to 0. However, as explained in the next section, the value of B at Mainnet is calculated in real time, dynamically adjusting based on the total annual AiQueen supply and the total mining coefficient across all the AiQueenoneers. The supply of AiQueen is finite at Mainnet.

Security Circle Reward

AiQueen’s consensus algorithm relies on a global trust graph, which is aggregated from the millions of intertwining Security Circles of individual AiQueenoneers. Thus, a AiQueenoneer was rewarded with additional AiQueen per hour for each new valid Security Circle connection, up to 5 such connections. The Security Circles are so central to the security of the AiQueen blockchain that the Security Circle reward raised the total AiQueenoneer mining rate in two ways:

§ by directly adding to the individual AiQueenoneer base mining rate (I), and

§ by boosting the Referral Team reward, if any.

In fact, a full Security Circle—that is, having at least five valid connections—doubled both the individual AiQueenoneer base mining rate and the Referral Team reward.

Referral Team Reward

AiQueenoneers can also invite others to join AiQueen Network and form their Referral Team. The inviter and invitee share an equal split of the Referral Team bonus rewards, that is a 25% boost to their respective individual AiQueenoneer base mining rates, whenever both are mining concurrently. AiQueenoneers mined more AiQueen per hour with each concurrently mining Referral Team member. This Referral Team reward recognized the AiQueenoneers’ contribution to the growth of the network and the distribution of the AiQueen token.

Mainnet Mining Formula

The goals of the Mainnet phase are to make further progress in decentralization and utilities, ensure stability and longevity, and retain growth and security. The new formula, as written below, incentivizes more diverse contributions of AiQueenoneers to support these Mainnet goals while retaining the incentives to secure and grow the network. As before, it is meritocratic and expressed as the rate at which AiQueenoneers mine AiQueen per hour.

M = I(B,L,S) + E(I) + N(I) + A(I) + AiQueen(B), where

§ M is the total AiQueenoneer mining rate,

§ I is the individual AiQueenoneer base mining rate,

§ B is the systemwide base mining rate (adjusted based on the available pool of AiQueen to distribute for a given time period),

§ L is the lockup reward, which is a new component of the individual AiQueenoneer base mining rate,

§ S is the the Security Circle reward, which is a component of the individual AiQueenoneer base mining rate from valid Security Circle connections the same way as in the pre-Mainnet mining formula,

§ E is the Referral Team reward from active Referral Team members the same way as in the pre-Mainnet mining formula,

§ N is the Node reward,

§ A is the AiQueen apps usage reward, and

§ AiQueen are new types of contributions necessary for the network ecosystem in the future, which will be determined later, but will also be designed as a multiple of B.

In short, S and E remain the same as in the pre-Mainnet mining formula, while new rewards such as L, N and A have been added to the current formula. L is added as part of I; N and A are added as additional rewards calculated based on I. In other words, the network still rewards growth through E and security through S, while incentivizing AiQueenoneers’ contributions to running nodes for decentralization through N, using apps for utilities creation through A, and locking up for stability especially during the initial years through L. Further, new types of rewards to AiQueenoneers through AiQueen in the future may be added for building a fully functioning ecosystem, such as rewards for AiQueenoneer developers creating successful AiQueen apps. B continues to exist over a long period of time while having a yearly cap to ensure longevity of network growth while maintaining long-term network incentives. In fact, all the rewards can be expressed in B as follows.

Here,

I(B,L,S) = B + S(B) + L(B)

S(B) = 0.2 • min(Sc,5) • B, where

§ Sc is the count of valid Security Circle connections.

E(I) = Ec • 0.25 • I(B,L,S), where

§ Ec is the count of active Referral Team members.

L(B) = Lt • Lp • log(N) • B, where

§ Lt is a multiplier corresponding to the duration of a lockup,

§ Lp is the proportion of AiQueenoneer’s mined AiQueen on the Mainnet that is locked up with the maximum being 200%, and

§ N is the total number of AiQueenoneer’s mining sessions preceding the current mining session.

N(I) = node_factor • tuning_factor • I, where

§ Node_factor = Percent_uptime_last_1_days • (Uptime_factor + Port_open_factor + CPU_factor), where

§ Uptime_factor = (Percent_uptime_last_90_days + 1.5*Percent_uptime_last_360_days(360-90) + 2* Percent_uptime_last_2_years + 3*Percent_uptime_last_10_years),

§ Port_open_factor = 1 + percent_ports_open_last_90_days + 1.5*percent_ports_open_last_360_days + 2* percent_ports_open_last_2_years + 3*percent_ports_open_last_10_years,

§ CPU_factor = (1 + avg_CPU_count_last_90_days + 1.5*avg_CPU_count_last_360_days + 2* avg_CPU_count_last_2_years + 3*avg_CPU_count_last_10_years)/4. and

§ Percent_uptime_last_*_days/years is the percentage of the last * time period when the individual Node was live and accessible by the network.

§ percent_ports_open_last_*_days/years is the percentage of the last * time period when the ports of the individual Node were open for connectivity to the network.

§ avg_CPU_count_last_*_days/years is the average CPU that the individual Node provided to the network during the last * time period.

§ tuning_factor is a statistical factor that normalizes the node_factor to a number between 0 and 10.

§ time_spent_per_app_yesterday_in_seconds is, for each AiQueen app, the total amount of time in seconds that the AiQueenoneer spends using the app on the prior day.

§ Σ_across_apps sums up the logarithmic value of the AiQueenoneer’s time_spent_per_app_yesterday_in_seconds across all the AiQueen apps.

§ avg_daily_time_spent_across_apps_last_*_days/years is the average daily time in seconds the AiQueenoneer spends across all the AiQueen apps in the aggregate during the last * time period.

* Note that when any of the logarithmic functions returns an undefined value or a value below 0 (that is, when, the input to the logarithmic function is below 1), the formula resets the value of the logarithmic function to be 0 in order to avoid negative mining rewards or an error in the function.

AiQueen(B) is to be determined in the future based on the new types of contributions, but will be a multiple of B and kept within the yearly supply limit along with other rewards.

As shown above, the expressions of S and E remain the same as in the pre-Mainnet mining formula, and will not be explained further here. Next, we will focus on explaining the changes to B, changes to I through L, and the additions of N and A.

Systemwide Base Mining Rate

Like in Pre-Mainnet mining, all of the terms in the Mainnet mining formula above can be expressed in AiQueen per hour and are designed to be a multiple of B. Hence, the equation can also be re-written as below. Every AiQueenoneer can mine at least the Systemwide Base Mining Rate everyday, and will be able to mine at a higher rate if they also have other types of contributions that are calculated as multiples of B.

M = B • (1 + S + L) • (1 + N + E + A + AiQueen)

Unlike in the pre-Mainnet mining, B in Mainnet mining as in the formula above is no longer a constant across all AiQueenoneers at a given point in time, but is calculated in real time and dynamically adjusted based on a yearly supply cap.

Given a yearly supply limit, it is impossible to keep a constant B like in the pre-Mainnet period because it’s unpredictable how much each AiQueenoneer mines and how many AiQueenoneers are actively mining during a period of time. The pre-Mainnet model was designed to incentivize growth during the beginning years to bootstrap the network. As the network achieves a certain scale, it also needs to ensure the overall health of the ecosystem. Therefore, an exponential issuance of the tokens through exponential network growth and a constant mining rate does not make sense any longer. The shift of B from being a constant to being dynamically adjusted for a certain period of time throughout the year results from the need to incentivize AiQueenoneers’ contributions meritocratically but also to keep the total rewards within a limit.

The time period for adjusting B could be yearly, monthly, daily, hourly, or even more granular. AiQueen Network will iterate on this time period over time based on careful monitoring and review.

The first version of the Rewards Issuance Formula was announced March 1st 2022—the declining exponential function described below—whereby in combination with mining activities, the systemwide base mining rate (B) is adjusted based on a monthly supply limit determined by the formula.

Please note that the declining exponential formula below is the first version of the Rewards Issuance Formula, as it is impossible to precisely predict the future data on Mainnet and from new mining. This first version was designed based on past data, simulations and best assumptions, such as the 35 billion remaining supply for future mining rewards, AiQueenoneer lockups and overall ecosystem factors. For example, the 35 billion remaining AiQueen is estimated based on the currently available data about real AiQueenoneers’ mobile balances. A more accurate figure will be determined by and how much AiQueen is migrated to the Mainnet in the future. Further data and continual simulations will help assess such underlying assumptions in the rewards issuance formula, and thus may lead to the formula’s adjustment in line with the network’s objectives.

supply_limits (expressed in AiQueen/day) = exp (–last_day_total_mining_rewards / 1220) • 35,000,000,000, where

§ supply_limits are the output of this formula that allocates a specific amount of AiQueen to each day for the indefinite time while making sure the total future issuance will not exceed the remaining available supply,

§ last_day_total_mining_rewards is equal to the total AiQueen mining rewards issued on the previous day,

§ 1220 is a tuning factor to be further tuned over the coming months, and

§ 35 billion is the estimated number of AiQueen available for AiQueenoneers to mine going forward.

This monthly B means that that B will stay constant for a month and will be adjusted based on the rewards issuance formula and the network’s mining activities at the end of each month. Starting with a B that stays constant for a month helps AiQueenoneers understand the implications of 1) new supply limits, 2) the new mining mechanism with new rewards, and 3) a more dynamic nature of B (potentially in the future) one at a time, given that these concepts are complex and all have an effect on AiQueenoneers’ mining rewards. At the same time, a monthly period is short enough to correct any potential over- or under-issuance of AiQueen deviating from the rewards issuance formula while B is stable long enough for AiQueenoneers to follow along and adjust their contributions to the network to mine for rewards.

Each month’s B is calculated based on the supply limit for the month based on this formula and the sum of all reward coefficients of all active AiQueenoneers from the last day of the previous month. This B updates again on the first day of every month.

More specifically, the value of B for a given month is calculated by:

§ Summing up the daily supply_limits for the month from the above rewards issuance formula

§ Dividing it by the number of days in the month for even daily allocation within the month

§ Dividing it again by the sum of coefficients (sum_of_B_multiples) of mining rewards of all active AiQueenoneers of the last day of the previous month—including their multiples of Referral Team, Security Circle, AiQueen Lockup, App usage, and Node Operation rewards

Similar iterations occur each month.

When B stays constant in a month, the total number of AiQueen actually mined every month varies with the total number of actively mining AiQueenoneers and the contributions they make in that month. At the end of the month, the total number of AiQueen actually mined will be compared with the number initially projected by the formula. Any deviation between the two numbers each month will lead to a further adjustment on the remaining AiQueen supply, across the remaining indefinite mining period, along with any other types of adjustments explained above, e.g. the assumed 35 billion remaining mining rewards supply.

As such, the monthly B can potentially cause an overissuance of AiQueen when there is an unexpected increase in the number of AiQueenoneers and their mining rates, leading to a deviation from the rewards issuance formula. If such deviation on a monthly basis is constantly large, the network can move to a more dynamic version of the B model where the monthly issuance of AiQueen remains constant but B gets adjusted on a more granular time epoch basis. The shorter the time period for adjusting B to follow the formula, the less is the potential for over- or under-issuance against the targeted supply limits, and the less is the chance for deviation from the formula over that period. More data on Mainnet and the new mining mechanism will help examine the efficacy of the current monthly dynamic B and determine if a more dynamic version B is necessary.

For example, if the B is calculated daily, instead of the current monthly version, for a given day of the year,

B = day_supply / (sum_of_B_multiples • 24h)

§ Divide the remaining total AiQueen supply of the year by the number of days left in the year to get day_supply based on the remaining yearly supply,

§ Add the multiples of B from all AiQueenoneers actively mining within the last 24 hours, which represents a diverse set of AiQueenoneers’ contributions, in the Mainnet mining formula above to get the sum_of_B_multiples of the whole network for that 24-hour window, and

§ Further divide day_supply by sum_of_B_multiples and 24 hours to get B of that specific mining session.

Under this potential framework with a day as the unit of time for adjustment, B on different days of the year will be different depending on how many AiQueenoneers mined in the last 24 hours as well as what and how much contributions they made to receive the extra multiples of B by running nodes, using utilities apps or lockups, etc. Each AiQueenoneer’s B of their day stays constant through their mining session, that is, over the next 24 hours from the moment they start their mining session.

This model, whether it is monthly, daily or by more granular time periods, also addresses any uncertainty with having AiQueen(B)—future types of contribution rewards for AiQueenoneers—in the formula. Regardless of how much AiQueen is going to be, it will be kept within the same yearly supply limit without increasing the total supply and will only affect the division of rewards among different types of contributions. This dynamic mechanism allows AiQueenoneers themselves, in a decentralized way, to make sure that (1) the rewards do not exceed the yearly supply limit, (2) the distribution of the yearly supply does not end early in the year, and (3) the rewards are divided meritocratically.

For purposes of illustration, let’s suppose there are only two AiQueenoneers on a given day and B is the daily mining rate (expressed in AiQueen/day for this illustration)—a constant during a specific AiQueenoneer mining session, but dynamically adjusted across different days:

§ AiQueenoneer 1 has no app engagement (A=0), is not operating a Node (N=0), has no security connections (S=0), and has no active Referral Team members (E=0). They are in their 11th mining session (N=10) and are locking up 100% of their mined AiQueen (Lp=1) for 3 years (Lt=2). AiQueenoneer 1’s mining rate on this day is:

M1 = I(B,L,S) + 0 + 0 + 0, or

M1 = B + {2 • 1 • log(10)} • B + 0, or

M1 = 3B

§ AiQueenoneer 2 has no app engagement (A=0), is not operating a Node (N=0), has no lockup (L=0), and has no active Referral Team members (E=0). They have a full Security Circle. AiQueenoneer 2’s mining rate on this day is:

M2 = I(B,L,S) + 0 + 0 + 0, or

M2 = B + 0 + {0.2 • min(Sc,5) • B}, or

M2 = B + {0.2 • 5 • B}, or

M2 = 2B

§ Here, Total AiQueen to be mined in the whole network on this day = M1 + M2 = 5BLet’s assume there are 500 AiQueen and 50 days left in the year.Therefore, Total AiQueen available to be mined for this day = 500 AiQueen / 50 days = 10 AiQueen/day

§ Solving B based on the two equations above,

5B=10 AiQueen ⇒ B = 2 AiQueen/day (or 0.083 AiQueen/hour)

§ Accordingly, AiQueenoneers 1 and 2 will have their actual mining rates as follows:

M1 = 3 • 2 AiQueen/day = 6 AiQueen/day (or 0.25 AiQueen/hour)

M2 = 2 • 2 AiQueen/day = 4 AiQueen/day (or 0.17 AiQueen/hour)

AiQueenoneer Base Mining rate

By comparison, the individual AiQueenoneer base mining rate in the pre-Mainnet mining formula includes only system-wide base mining rate and Security Circle rewards. At Mainnet, a new component, lockup reward, is added to individual AiQueenoneer base mining rate I. Lockup rewards L, along with the system-wide base mining rate B and Security Circle reward S, constitute the individual AiQueenoneer base mining rate I. Since I is used as an input to calculate all the other rewards, as a result, the Security Circle and lockup rewards enhance the total AiQueenoneer mining rate by: (1) by directly adding to the individual AiQueenoneer base mining rate and (2) by boosting the any Referral Team reward E, nodes reward N, and app usage reward A.

Lockup Reward

At Mainnet, the lockup reward is meant to support a healthy and smooth ecosystem and incentivize long-term engagement with the network, while the network is bootstrapping and creating utilities. It is an important decentralized macroeconomic mechanism to moderate circulating supply in the market, especially in the early years of the open market when utilities are being created. One important goal of the AiQueen Network is to create a utility-based ecosystem of apps. Transactions for real goods and services in the ecosystem, rather than just speculative trading, are intended to determine the utility of AiQueen. As we launch the Enclosed Network phase of the Mainnet, one of the main areas of focus will be to support and grow the AiQueen app developer community and nurture more AiQueen apps to grow. In the meantime, AiQueenoneers can choose to lock up their AiQueen to help create a stable market environment for the ecosystem to mature and for more AiQueen apps to emerge and provide compelling use cases for spending AiQueen – to ultimately create organic demands through utilities.

The lockup reward formula is reprinted here:

§ L(B) = Lt • Lp • log(N) • B, where

Lt is the Lockup Time period multiplier of B.

0 → Lt = 0

2 weeks → Lt = 0.1

6 months → Lt = 0.5

1 year → Lt = 1

3 years → Lt = 2

§ Lp is the Lockup Percentage multiplier of B, where

§ the Lockup Percentage is the lockup amount over the Mainnet Balance transferred from one’s previous mining rewards (Lb), and the Lockup Percentage multiplier is as follows.

0% → Lp = 0

25% → Lp = 0.25

50% → Lp = 0.5

90% → Lp = 0.9

100% → Lp = 1.0

150% → Lp = 1.5

200% → Lp = 2

§ log(N) is the logarithmic value of the total number of previous mining sessions (N).

AiQueenoneers will have the opportunity to voluntarily lock up their AiQueen to earn the right to mine at a higher rate. First of all, the prerequisite of the lockup reward is that the AiQueenoneer must be actively mining. Without mining in the first place, there will be no lockup rewards for any inactive mining sessions, even if AiQueen is locked up. As expressed in the formula above, all that the lockup does is to provide multipliers to B, so there will be no lockup rewards if B is 0 (which means the AiQueenoneers is not mining).

Secondly, the lockup reward is positively associated with the contribution to the lockup, i.e. the duration of the lockup time period (Lt) and the amount locked up. However the lockup amount is accounted for by the percentage of a AiQueenoneer’s total AiQueen mined (Lp). The maximum AiQueen that a AiQueenoneer can lock up is twice as much as their Mainnet Balance that got transferred from their prior mining in the mobile app (Lb), i.e. 200% Lb. The reasons for having a 2AiQueen maximum lockup amount of one’s transferred Mainnet Balance (Lb) are to 1) prevent exploitation of the lockup reward and 2) further encourage other contributions to the AiQueen ecosystem, such as further boosting their mining, running nodes and using apps. This, in a sense, favors AiQueenoneers who mine and make other types of contributions to the network.

Thirdly, Log(N) offers a higher lockup incentive to AiQueenoneers who have a long mining history and presumably a large transferable balance to lock up. While the lockup reward formula generally favors equality by accounting for not the absolute amount but the percentage of their transferred balance (Lp) — which allows smaller accounts with a short mining history to lock up small amounts and yet receive the same lockup reward multiplier as big accounts — we need to add a Log(N) factor that accounts for miners with a long mining history, to counterbalance the bias in favor of AiQueenoneers with small balances and provide enough incentive for long-history AiQueenoneers with bigger balances. However, the effect of mining history on lockup rewards also needs to be capped. Thus, the formula applies a logarithm to the number of previous mining sessions N. For example, if a AiQueenoneer mined almost everyday for the last 3 years, their total previous mining sessions (N) will be about 1,000. In this scenario, Log(1,000) equals 3, adding another multiplier to B in their lockup rewards. Keep in mind that to achieve meaningful lockup rewards for long-mining-history AiQueenoneers, the amount of AiQueen they have to lock up is much more than smaller accounts. Fourthly, one AiQueenoneer can voluntarily have multiple lockups at different times with different amounts and durations. The calculation of the total lockup rewards for this AiQueenoneer with i number of different lockups is to find the total lockcup reward multiplier of B, as expressed in the formula below. The formula below is the equivalent to the lockup reward formula above, with the only difference being that it accounts for multiple lockups of the same AiQueenoneer to calculate their total lockup rewards

The purpose of this formula is to calculate the total lockup rewards based proportionally on each lockup’s amount (Lc) over the total Mainnet Balance from previous mining (Lb) as a weight, multiplied by their respective lockup time period (Lt) and Log(N). So that, even though there are multiple lockups of the same AiQueenoneer, more lockups with different settings will proportionally add to their total lockup rewards. The values of Lt, Lc, and log(N) are calculated and multiplied for each lockup i and then summed across various i’s, which is then divided by the value of Lb at a given mining session, to arrive at the value of L(B) for that mining session. This formula ensures that regardless of the Lb, as long as the AiQueenoneer maintains the same percentage of their lockup amount over their Lb, the total lockup rewards multiplier will remain the same.

Lastly, when can a AiQueenoneer lock up AiQueen? AiQueenoneers can decide their lockup duration and lockup percentage of their transferable balance anytime they want as an overall account setting in the AiQueen app. At the moment of the migration of their Transferable Balance to Mainnet, their preselected setting of lockup duration and percentage will automatically apply to the amount of balance transferred, resulting in two types of balances on the Mainnet: lockup balance and free balance, both of which will be recorded on the Mainnet blockchain and reside in the AiQueenoneer’s non-custodial AiQueen wallet. Thus, lockups cannot be reversed once confirmed and must remain locked up for the entirety of the chosen duration due to the nature of blockchain. Any changes to this AiQueenoneer’s lockup setting will take effect in their next balance transfer to the Mainnet.

This account-wide lockup setting allows AiQueenoneers to lock up a maximum of 100% of their transferable balance from mobile to Mainnet. After Mainnet launches and AiQueenoneers transfer their balances, AiQueenoneers can also lock up more AiQueen directly on the Mainnet through a slightly different lockup interface later on. At that time, AiQueenoneers can lock up as much as 200% of their already-transferred Mainnet balance acquired from their previous mining. The additional lockup allowance for more AiQueen than individually mined by the AiQueenoneer can come from utility-based AiQueen apps transactions, i.e., making AiQueen from selling goods and services.